We all want to have a comfortable retirement, right? Hence we work ourselves to the bone, forfeiting some of ‘today’s’ pleasure so that we can save enough to invest later and have a comfortable retirement.

Saving is very hard because there are always pleasures and pressures that want to draw from your pocket daily. Some financial institutions have made saving in preparation for retirement easy.

They provide plans like a Defined Contribution DC) plan and Individual Retirement Accounts (IRA) where employees save their money in preparation for retirement. The advantage of these plans is that your money accumulates tax-free.

What Is a Defined Contribution Plan?

It is a retirement plan in which an employee contributes a specific amount to an account in preparation for retirement.

With this plan, individual accounts are created for participants and their benefits are calculated according to the credited amounts and other investment earnings from the money in the account.

There is a fixed amount of your pay that you have to contribute to this DC plan in preparation for retirement.

Sometimes your sponsor company can match your employee contributions which benefit you. DC plans have restrictions regarding how and when you can withdraw from your account without penalties.

The advantage of this plan is that your money accumulates tax-free, sometimes called tax-deferred. Sometimes your employer may contribute to their employee’s DC account.

Types of DC Plans

401 (K) Plan

The commonest DC plan is the 401(k) defined as the tax-advantaged defined-contribution plan that is offered to employees by their employers. It derives this name from a section of the U.S Internal revenue code.

Employees contribute to their 401 (K) account using automatic payroll withholding. Their employers may decide to match all or some of those contributions.

Investment earnings in a 401 (K) plan are not taxed until you decide to withdraw your money, which is usually after retirement. Note that Roth 401 (k) plan withdrawals may be tax-free. It is available to employees of businesses and public corporations.

Other DC plans include 403 (b) plans accessible by employees of nonprofit organizations and public education entities. In a 401 (a) plan, the employer establishes contribution amounts, custom eligibility requirements, and investing schedules.

These are common in government, non-profit and educational employees. It is usually an added incentive to have these employees stay in the organization.

How Defined Contributions Work

Almost all the DC plans work the same way. The employer chooses how much money they are willing to contribute and the employer deposits it in the account on behalf of the employer.

Usually, it will be a percentage of the employer’s paycheck or a certain dollar amount. Contributions will be deducted from the employee’s paycheck and deposited on the DC plan automatically.

Other employers can sometimes agree to kick in part of their own money, called matching. A matching contribution is usually 50 cents per each dollar that an employee contributes up to a certain percentage of their salary normally.

That amount normally ranges from 3 to 6%. It’s up to the employer to decide how they want to invest their contributions. They can choose from various mutual funds, annuities, or stocks and money market funds options for investment.

DC Restrictions and Limits.

As an employee, you don’t need to contribute to a defined contribution plan. However, you will be missing out on a retirement savings opportunity. By 2019, employees under 50 could contribute up to $19000.

The 2020 limit is $19,500 for employees under 50 years of age. For over 50-year-olds, the limit is $26,000. Note that you are liable to a penalty if you withdraw funds before you clock the retirement age.

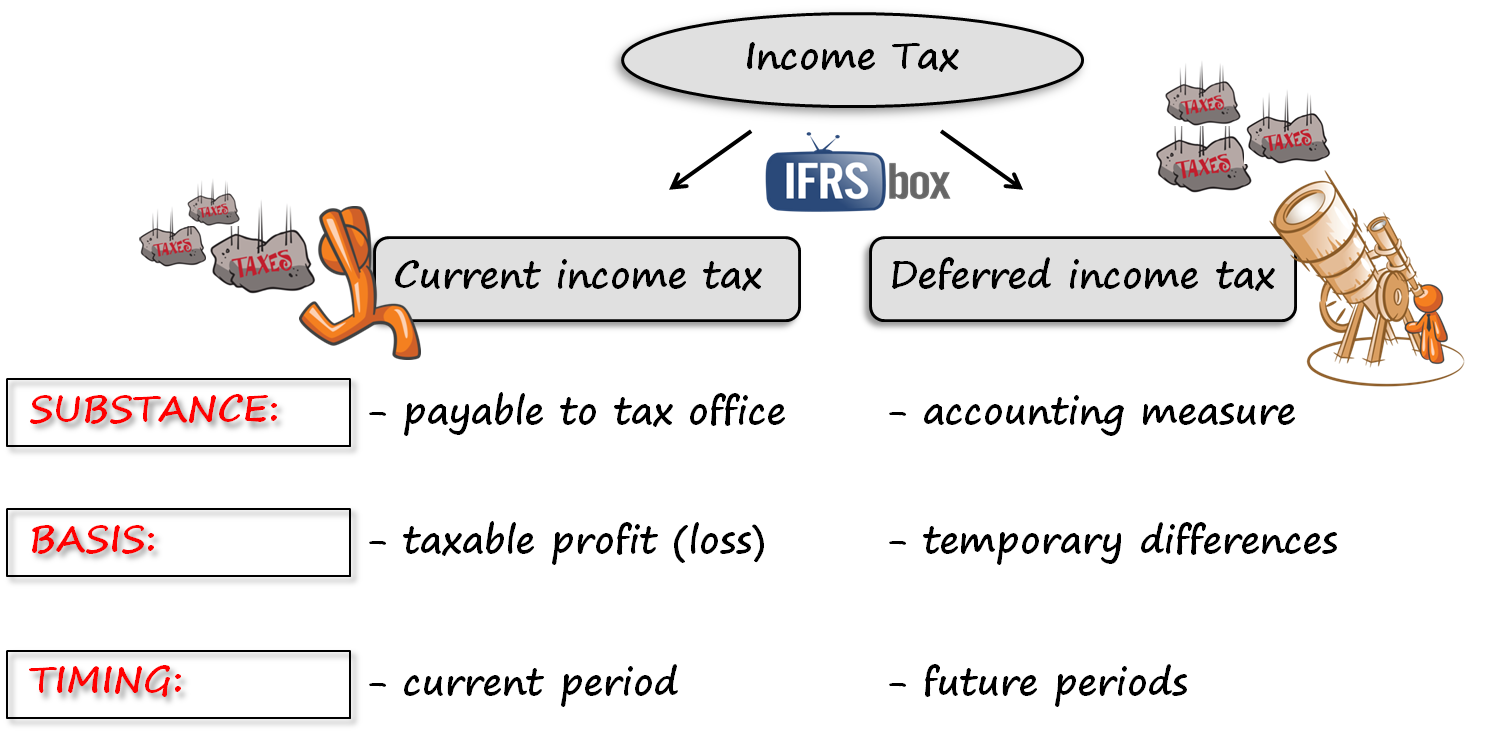

How Tax-Deferred Works

A tax-deferred status means investment earnings like capital gains, interest, or dividends that accumulate tax-free until you take a constructive receipt of the profits.

The common examples of tax-deferred investments are deferred annuities and Individual retirement accounts.

It is important because as an investor, you’ll benefit from the tax-free growth of your earnings. If you hold your investments till retirement, your tax savings are quite substantial.

Conclusion

With a DC Plan, you will be asked to choose the amount you want to contribute as a certain percentage of your paycheck. Other times you can also match your own money in accordance to your financial plan.

The amount will be deducted and credited to your account automatically.