With today’s high costs of living, it is hard to keep out of debt. Also, the high rate of unemployment has led to too many responsibilities on the member of the family that is earning.

If one person in the partnership can’t find a job, then the family costs are all put onto one person. This can be too much. Imagine if you have to pay for insurance, mortgage/rent, groceries, utilities, and more for a household.

You might end up incurring debts because all these bills are essential. However, don’t be overwhelmed with debt. Learn how to use debt management consolidation below.

Debt Consolidation vs Debt Management

Both debt management and debt consolidation are debt relief options that are to lessen debt pressure on you.

Debt consolidation involves taking a loan to settle the outstanding debt or debts while debt management requires you to organize and execute a repayment plan.

If you are swimming in a pool of debt, you might want to consider one of these options to help you pay off your debts. You want to understand each one of them before you pick one. Let us look at each one of them.

How Debt Management Works

Debt management is a method that requires you to work with a credit counseling agency to help you plan and execute a repayment plan.

The credit counselor will review your finances and help you formulate a plan that you must stick to if you need to manage your debt.

Sometimes, credit counselors may try to talk to your creditors on your behalf to negotiate lower interest rates on your debt.

Negotiating with Creditors

During negotiation, creditors may waive fees and lower your accounts’ interest rate in case you accept to repay the debt through a debt management plan (DMP).

The goal of using DMPs is to have your debts repaid fully within a period of three to five years. This will be easier for you given the lower interest rate you are to pay monthly.

Some debt management plans will outline for you the optimal monthly payment amount and how long you will need to pay it back based on your financial status and debt.

How a Credit Counselor Helps with Debt Management

Your credit counselor will hold you accountable for following the laid-out plan.

Depending on the agreement you have, your counselor may take over repayment for you as you pay them each month and allow them to make a payment on your behalf.

Many credit counseling agencies are nonprofit organizations that offer assistance and education that help people manage their finances.

When you choose to work with a DMP, you’ll make a monthly payment to the counseling agency that it will issue out to your creditors. DMPs are used on accounts that don’t have collateral like credit cards.

Debt Consolidation Options

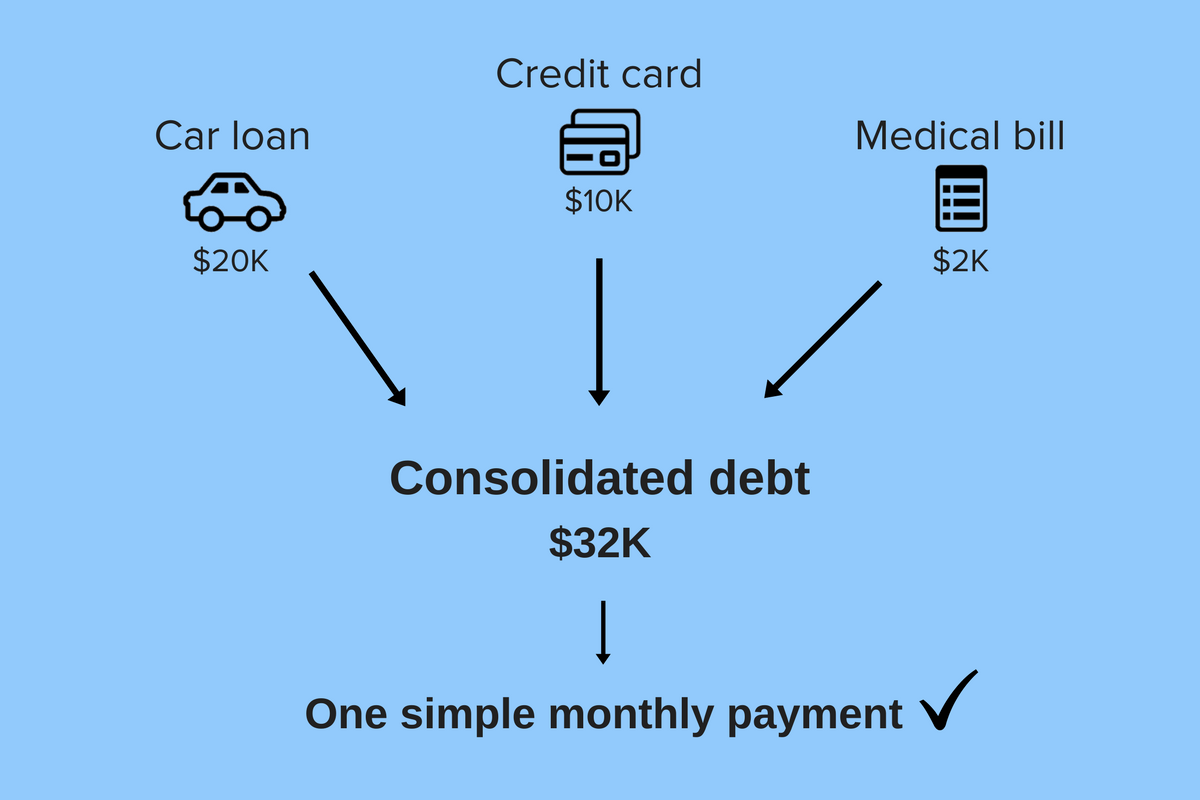

Debt consolidation is when you consolidate your different high-interest debts like credit cards into a single monthly payment preferably at a lower interest rate.

Debt consolidation involves two ways that can help you restructure your monthly payments and save money on interest. These ways are debt consolidation loans and balance transfer credit cards.

Debt Consolidation Loan

It is a loan you take that is supposed to wrap all your other debts into this single monthly payment. This helps you save money on interest with time.

It requires you to open a new account that can either be a personal loan account or a new credit card. Your monthly payment will be to finance this single loan as opposed to paying different creditors.

Balance Transfer Credit Card

This pools all your existing credit card debt onto one card. This is ideal for people with various credit cards and each has its credit for you to pay.

This situation can stress the heck out of you when you start getting different emails and calls from all your creditors. Getting this card is a relief because you’ll be paying off a single debt which is easier.

Sometimes balance transfer cards are paid at 0% interest or a very little fee.

Bottom Line

Debt consolidation s an expensive choice because all of the fees you will pay, but if you have no other choice, check out all the debt consolidation plans available to you.

And just remember that even if you use debt consolidation, you need to make a financial plan so you don’t get stuck again.